Loans for government employees with bad credit

Credit cards allow you to pay for products and services now but you need to repay the balance before the end of your billing cycle to avoid paying interest for your purchase. However business credit cards are ideal for businesses that are just starting up because business credit card issuers will use an applicants personal credit scorerather than a businesss credentialsas the main decider for their approval.

3 Credit Union Loans For Bad Credit Top Alternatives Badcredit Org

Bad Credit Business Loans.

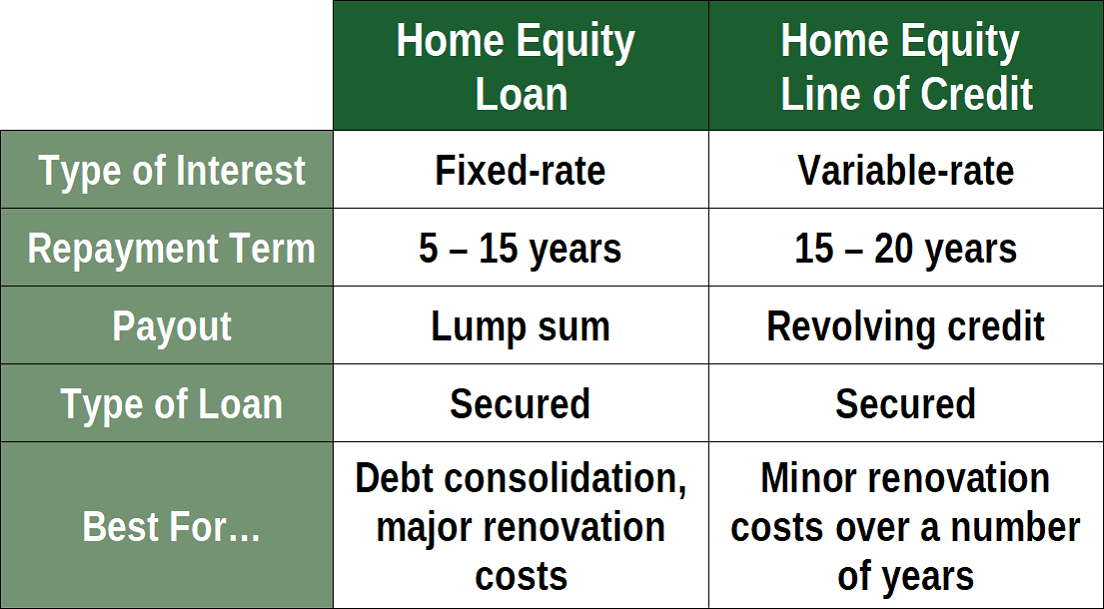

. Small Business Administration helps small businesses get funding by setting guidelines for loans and reducing lender risk. Common personal loans include mortgage loans car loans home equity lines of credit credit cards installment loans and payday loansThe credit score of the borrower is a major component in and underwriting and interest rates of these loansThe monthly payments of personal loans can be decreased by selecting longer payment terms but overall interest paid. The credit union will report your payments to one or more of the three credit bureaus TransUnion Experian and Equifax.

Citizen or eligible non-citizen and being enrolled in an accredited school. Many credit unions offer credit builder loans which are small loans secured by a savings account. Auto loans for federal government employees are installment contracts that use the equity in your vehicle as collateral.

Also referred to as cash loans they are usually for. Pre-qualify for your personal loan today. The lender relies on the legal right to repossess your car after default to minimize losses instead of a signature promise to pay.

Federal and private loans. Federal student loans for bad credit. Therefore make sure to spend all proceeds right away.

Use payroll loans as a form of gap financing to avoid any delays in paying your employees. Instead the government will just verify that you meet the basic requirements like being a US. A credit score lower than 500 may not qualify at all.

In order to get an SBA-backed loan. The lending network that CreditLoan uses specializes in small loans up to 5000 for borrowers with poor credit. A bad bank is a corporate structure which isolates illiquid and high risk assets typically non-performing loans held by a bank or a financial organisation or perhaps a group of banks or financial organisations.

Federal government employees with bad credit and low FICO scores. For example residents of a certain town or employees of a particular industry. The thing is that lenders love dealing with government employees particularly with USPS workers and they give payday advance for postal workers at good conditions.

Bad credit can be a serious obstacle to borrow money from banks and other traditional options but your poor credit history will not prevent you from getting financial help when you need it if you are a federal employer. These SBA-backed loans make it easier for small businesses to get the funding they need. System credit unions and other non-traditional lenders.

If you are looking for lenders to get cash advance for postal employees you will find them without any problems on the Internet. Payday loans work like cash advances against your next SSI payment. Visit our Loans page to find the loan that best suits your need.

Up to 100000. 13 17 94. Perhaps it arrives in 24 to 48 hours instead of up to 30 days later.

Many families are entitled to Government cash but arent aware theyre eligible. If you are on government benefits ask if you can receive an advance from Centrelink. Small Business Administration SBA loans are offered by the Federal Government to small business who qualify.

Weve listed credit unions. Bad Credit Loans. Two common unsecured loans are credit cards and student loans.

These loans are designed for government employees who have a low credit score such as militaries postal employers etc. In other words you get your money sooner. National Health Service Corps Rural Community Loan Repayment Program.

A credit card company sets a credit limit on how much you can charge on your card when it. FSA has the responsibility of approving all eligible loan guarantees and providing oversight of the lenders activities. FREE Weekly MoneySaving email.

In some cases even those earning up to 50000 may get help. Federal and private loans. Most federal student loans dont take your credit score into account when determining eligibility.

Reclaim payday other bad credit loans. Compare personal loans from online lenders like SoFi Marcus and LendingClub. A bank may accumulate a large portfolio of debts or other financial instruments which unexpectedly become at risk of partial or full default.

Rates start as low as 5 for qualified borrowers. Installment Loans with Bad Credit. In order to be considered business should have at least three years of operating history a minimum FICO.

Lousy credit history will only get worse if your government benefits stop arriving. Of course higher credit scores will always get you better rates and terms. Direct loans are made and serviced by FSA using funds from the Federal Government.

Loan requirements beyond owning a bank or credit union account are not specified on the CreditLoan website but we expect it includes the customary items regarding age citizenship income phone and email account. FSA guarantees the lenders loan against loss up to 95 percent. Loan amounts range from about 1000 to 50000.

However if you have poor credit or a. Many people overlook business credit cards as a viable business funding option especially if they have bad credit. Credit scores in the 700s and 800s will get the lowest interest rates.

You repay the principal with interest for a set term until you finish repaying the loan. Like all personal loans bad-credit loans have fixed rates and are repaid in fixed monthly installments over a period of two to seven years. Payday loans are loans with low borrowing amounts and short terms and are available to Centrelink applicants as well as those with bad credit.

2022 S Best Installment Loans For Bad Credit

Best Bad Credit Personal Loan Rates In September 2022

Where To Get A 10 000 Personal Loan Credible

5 Best Emergency Loans For Bad Credit List Of Online Payday Lenders To Get Same Day Payday Loans In 2022 Paid Content Cleveland Cleveland Scene

9 Best Personal Loans For Bad Credit 2022 Reviews Badcredit Org

Online Loans For Bad Credit Easy Fast Approval Weloans

5 Best Loans For Bad Credit Of 2022 Money

How To Get A Business Loan With Bad Credit Small Business Trends

10 Guaranteed Installment Loans For Bad Credit 2022 Badcredit Org

6 Best Bad Credit Loans Of September 2022 Fox Business

Personal Loans With 550 Credit Score Can I Get One Credible

5 Best Loans For Bad Credit Of 2022 Money

Loans For Veterans With Bad Credit Va Financial

With Favourable Changes In The Legislative Environment India S Six Major Cities Mumbai Bengaluru Pune New Delhi Chenna Realty Economic Times Real Estate

4 Best Hardship Loans For Bad Credit 2022

How To Get A Car Loan With Bad Credit Forbes Advisor

Getting A Business Loan Is Never A Simple Proposition And While The Lending Situation Has Improved Steadily Sin Business Loans Finance Saving Accounting Firms